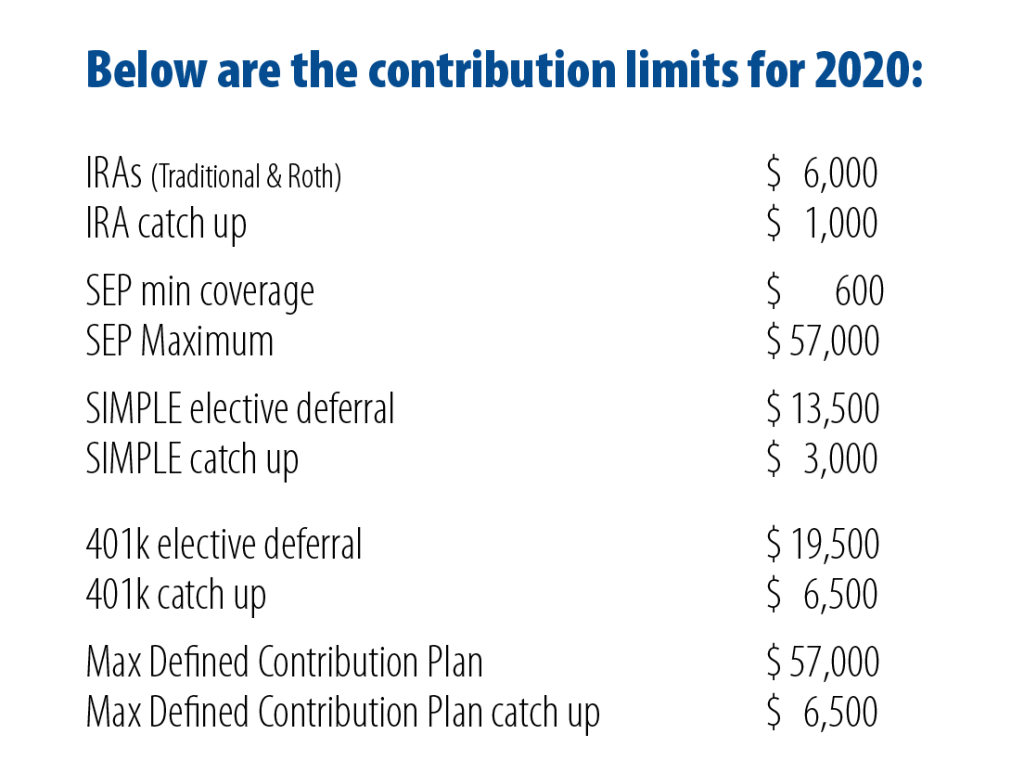

Married Filing Jointly Ira Limits 2025. Contributions begin phasing out above those amounts, and you can't put any money into a roth ira once your income reaches $161,000 if a single filer or $240,000 if. If your modified agi is less than $230,000, then you are able to contribute up to the $7,000 contribution limit ($8,000 if you’re age 50 or older) in 2025.

In 2025, married couples filing jointly can contribute to a roth ira if their magi is less than $230,000. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Roth Ira Contribution Limits 2025 Married Filing Jointly Per Person Josey Mallory, If you're age 50 or older, you're eligible for extra contributions as well.

Ira Contribution Limits 2025 Married Adina Arabele, If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras is the same:

Ira Limits 2025 Married Filing Jointly Married Dorie Geralda, You can’t make a roth ira contribution if your modified agi is $228,000 or more.

Roth Limits 2025 Married Filing Joint Drusi Isadora, You could earn a credit of 10%, 20%, or 50% of your contributions, up to a dollar amount of $2,000 ($4,000 if married filing jointly) as long as you're eligible.

Ira Limits 2025 Married Filing Jointly Married Dorie Geralda, If your modified agi is less than $230,000, then you are able to contribute up to the $7,000 contribution limit ($8,000 if you’re age 50 or older) in 2025.

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras is the same:

Roth Ira Limits 2025 Married Filing Jointly Irs Shela Dominica, You could earn a credit of 10%, 20%, or 50% of your contributions, up to a dollar amount of $2,000 ($4,000 if married filing jointly) as long as you're eligible.

Ira Limits 2025 Married Filing Jointly Married Wilow Petrina, If you’re married filing jointly or a qualifying widow(er):

Married Filing Jointly Roth Ira Limits 2025 Hildy Latisha, The 2025 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly.

Married File Joint Standard Deduction 2025 Renae SaraAnn, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025 and 2025.